Selling a car that’s still under a loan can be a bit complex, but it’s possible with the right steps. Suppose you’re wondering how to sell a financed car without paying it off. In that case, the process involves balancing your current auto loans with the sale proceeds from the vehicle, ensuring a smooth transaction for both you and the buyer. Whether you want to upgrade to the next car or simply free your finances, you'll first need clarity on numbers. With careful planning, you can maximize value and potentially make more money from the sale.

What Does an Outstanding Loan Mean?

When selling a car that is not paid off, you’re essentially dealing with an outstanding loan, meaning there’s still a remaining amount owed to the lender on your current vehicle. This loan balance must be settled before ownership can transfer to the new owner. Whether the buyer or you pay off the entire loan, it’s a crucial step to clear the title and ensure that the lender has no further claim on the car, allowing a clean sale transaction.

Finding Out Your Car’s Value

Knowing the true market value of your old car is essential when selling a financed car. This value helps determine if your vehicle has positive or negative equity, which impacts how smoothly the sale will proceed. Various online tools and local dealerships can provide an estimated market value, but a precise valuation is often possible with a VIN decoder. By checking details like mileage, accident history, and model specifications, you get a clearer picture of your car’s worth. Additionally, if your financed car hurts or is heavily used, it might lower the value, making it harder to cover the remaining auto loan. Understanding this helps you make informed decisions on car loans and any potential losses. Accurately assessing your car’s value ensures you’re prepared for any shortfalls and can negotiate confidently.

Understanding Your Car’s Equity

Private Sale with Positive Equity vs Private Sale with Negative Equity

| Aspect | Private Sale with Positive Equity | Private Sale with Negative Equity |

| Loan Payoff | The car's value exceeds the loan payoff, so you can settle the loan and keep any remaining funds. | The car’s value is less than the loan payoff, meaning negative equity requires covering the shortfall. |

| Financial Outcome | You keep extra cash from the sale after paying off your loan. | You may need to pay the remaining balance out of pocket or work out an arrangement with the buyer or lender. |

| Title Transfer | Straightforward transfer after loan settlement, making the process smooth for both parties. | Title transfer may be delayed until the payment gap is covered, adding complexity to the sale. |

| Buyer Appeal | Buyers are typically more comfortable with positive equity, knowing the title transfer is straightforward. | Buyers may hesitate if they’re concerned about the outstanding loan complicating the sale. |

| Negotiating Power | Positive equity can strengthen your position, allowing control over sale terms without financial constraints. | Negative equity limits negotiating power, as additional funds or financing may be necessary to complete the sale. |

| Involvement of Lender | Minimal lender involvement, simply requiring loan payoff to release the title. | Active lender involvement may be necessary to address outstanding debt or arrange a payoff plan. |

Asking Your Lender for Instructions

If you’re looking for the best way to sell a car with a loan, contacting your lender is a key step. Start by confirming your payoff amount—the balance needed to clear the car loan. Visiting the lender's office in person can speed up the process and provide you with clear guidance on releasing the title. If your loan is upside down, your lender may suggest refinancing options or even transferring the debt to a new lender. Checking your current interest rate for a car loan can also reveal potential savings if a new loan becomes necessary. By following your lender’s guidance, you’ll have a clear path to finalize the sale smoothly.

What to Do When the Bank Wants the Payoff Before You Sell Your Vehicle

If you need to sell a car to pay off debt but still owe money, some banks may require the loan to be fully paid before transferring the title. In this case, ensure that your selling price covers the outstanding balance. You might need to arrange for a personal payment to cover any shortfall if the sale proceeds fall short. This step is essential for managing personal finance responsibly and efficiently clearing debt.

Is It Better to Sell to a Private Party or a Dealer?

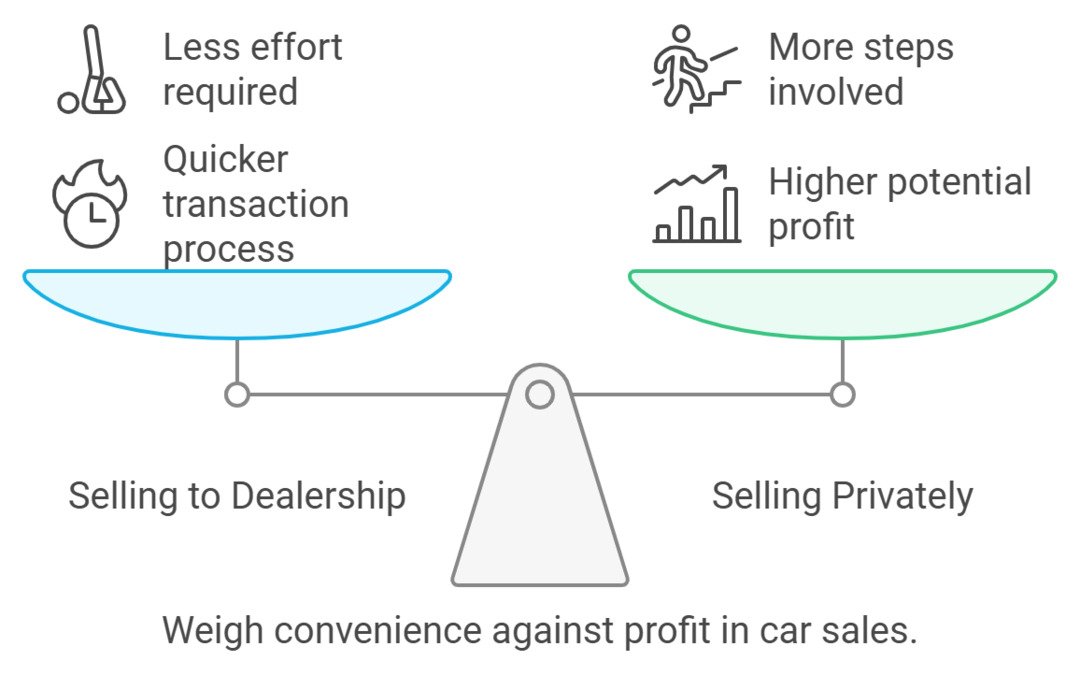

When selling a car with a loan, deciding between a private buyer and a dealership can impact your outcome. Selling to a dealership is generally quicker, especially if you have a personal loan or owe funds to online lenders, as they often handle the car title transfer on your behalf. However, selling the car privately may yield a higher price, making it more profitable despite requiring additional steps. Additionally, considering the best time to sell a used auto can influence your decision, as market conditions affect demand and offer potential financial benefits. Ultimately, weighing the convenience of a dealership sale against the potentially higher earnings from a private purchase can help you choose the best option for your financial needs.

Steps to Get Your Car Ready for Sale

- Gather Required Documents: Collect all paperwork, including the car title and any records related to motor vehicle registration, to ensure a smooth transaction.

- Check Loan Status: If you have a title loan, determine who buys cars with title loans to understand buyer options.

- Calculate Payoff: Review your new car loan balance to confirm how much you need to repay.

- Prepare for Transfer: Plan a few extra steps to clear the title and transfer ownership smoothly when you sell your car.

Can I Trade In a Car I Owe Money on?

It’s possible to trade in a car even if you owe money on it, but you’ll need to understand your trade-in value first. Dealers will normally run this against their book value to determine what they can offer. If the trade-in value is more than the loan, the difference might serve to pay off the remainder. However, if the offer is below value, you're supposed to top it off or make a more lucrative decision to sell privately. Taking a look at both a trade-in and a private-party sale will allow you to decide which option yields the best financial results.

Summary

Selling the car with a loan on it requires some planning and coordination with your lender to go through without hitches. Knowing how to sell a car with a loan will let you bring home maximum cash from its sale and avoid any possibility of debt creation. With that said, paying off the loan is key, and good credit might open doors for a new loan if needed. Surprisingly, preparing in advance would show how to rid your car even when you do not pay it off fully, with a high financial restart capability afterward.

Frequently Asked Questions

If you fail to pay off your car loan, your lender has the right to repossess the vehicle, as it’s technically their collateral for the loan. Missed payments can negatively impact your credit score, leading to a default record, which may affect your ability to secure future loans.

Yes, you can return a financed car if you can’t afford it, but it’s not as straightforward as simply handing it back. Voluntarily surrendering the car, a voluntary repossession, will likely impact your credit score. Alternatively, you might negotiate with the lender to see if refinancing or other payment plans are available.

No, you cannot transfer the title of a financed car directly, as the lender holds a lien on the vehicle until the loan is paid off. To transfer the title, you’ll first need to clear the loan balance, at which point the lender releases the lien.

In most cases, there are no specific tax consequences for selling a car with a loan. However, if you sell the car for more than the loan balance and make a profit, you might need to report that gain for tax purposes.