Buying a car as a student doesn’t have to break the bank, but it does require a smart plan. Start by focusing on practical, fuel-efficient models like the Toyota Corolla, Honda Civic, or Hyundai Elantra. They’re known for low maintenance costs and strong reliability. Set a strict monthly budget that includes insurance, gas, and repairs. If your credit history is limited, look into student-friendly financing or consider a used vehicle with a clean VIN report to avoid hidden issues. This guide will walk you through when to buy, what to look for, and how to get the best deal with a limited income.

Should You Buy a Car Before or After Starting College?

The timing of your car loan decision depends on several factors. These are your location, financial situation, and transportation needs. Many college students struggle with this choice. It affects their budget for the next four years. Consider your parking fees. Analyze whether you'll need a vehicle for work or internships. Some young people find it better to wait until they establish credit and income. Others need immediate transportation.

The best time for purchasing a car varies:

- Before college: Gives you time to save money and avoid rushing into a car loan.

- During freshman year: Allows you to assess actual transportation needs and parking availability.

- After establishing income: Provides better auto loan approval chances and more negotiating power with lenders.

- Summer breaks: Often offer better deals from dealerships looking to clear inventory.

- Senior year: Helps prepare for post-graduation job commuting needs.

How Much Should You Spend on Your First Car as a Student?

Car-related expenses should take no more than 10-15% of your total monthly income. This concerns monthly payments, insurance, gas, and maintenance. Such a conservative approach helps prevent overwhelming debt. Many students underestimate the total cost of ownership. It includes registration fees, parking permits, and unexpected repairs. Consider your current income sources. Determine how much you can put toward a vehicle budget. These may be part-time jobs, family support, or grants.

| Monthly Income | Recommended Car Budget | Maximum Payment | Down Payment Range |

| $500-800 | $50-120 | $35-85 | $500-1,500 |

| $800-1,200 | $80-180 | $55-125 | $800-2,000 |

| $1,200-1,800 | $120-270 | $85-190 | $1,200-3,000 |

| $1,800+ | $180+ | $125+ | $2,000+ |

Most Reliable Makes and Models for Students in 2025

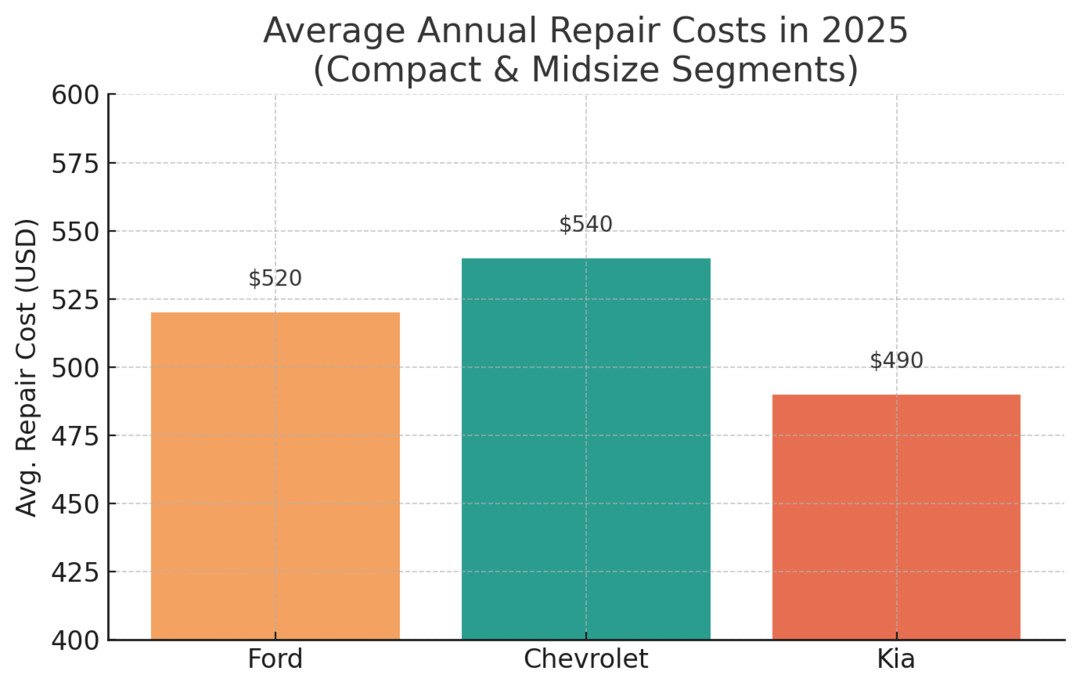

If you're looking beyond the usual recommendations, several brands offer strong reliability for students on a budget. Ford, Chevrolet, and Kia have improved significantly in long-term dependability over the past five years, especially in their compact and midsize segments. Models from these manufacturers are often easier to find on the used market, come with lower insurance premiums, and may qualify for local financing deals or student discounts.

Even in 2025, repair costs for brands like Kia, Ford, and Chevrolet stay under $550 a year on average. That’s a big deal for students who can’t afford surprise expenses and need a car that won’t drain their budget after purchase.

Low-Maintenance Cars for First-Time Owners

Pay attention to cars with proven track records. Additionally, consider relatively cheap replacement parts. Japanese manufacturers, for example, Toyota, Honda, and Mazda, consistently rank highest. These brands also offer extensive dealer networks.

Reviewing used cars with good mileage? Prioritize the following brands over luxury vehicles. Expensive models, such as sports cars, typically require expensive, specialized maintenance and premium fuel.

- Toyota Corolla/Camry: Excellent fuel economy and affordable service.

- Honda Civic/Accord: Strong resale value and reliable performance.

- Mazda3: Sporty handling with practical fuel efficiency.

- Nissan Sentra: Budget-friendly option with good warranty coverage.

- Hyundai Elantra: Extended warranty protection and competitive financing offers.

Buying a Car for Commuting vs. On-Campus Living

Your living situation significantly impacts the car's type. Commuter students typically need more fuel-efficient cars. Determine parking availability and fees at your college. Some locations charge $200-500 annually. Many students don't use their cars frequently. Thus, a slightly older, less expensive vehicle is a smarter financial choice.

| Living Situation | Priority | Financing Considerations | Insurance Factors |

| Commuter | Reliability, fuel efficiency | More money needed | Higher mileage rates |

| On-Campus | Weekend reliability | Lower monthly payments are acceptable | Lower mileage discounts |

| Off-Campus Apartment | Daily reliability | Balance of reliability and money | Standard rates |

| Frequent Travel Home | Highway comfort, reliability | Consider certified pre-owned | Comprehensive coverage important |

Commuter students drive an average of 12,000-15,000 miles annually. On-campus residents drive 6,000-8,000 miles.

What Is a VIN Report and Why Every Student Should Use One

A VIN decoder provides crucial history information that helps you identify cars with hidden problems. For students buying used cars from auction platforms or small local dealers, VIN reports are the only way to check if the car was ever in a serious accident, marked salvage or rebuilt, or had the odometer rolled back. These risks are especially high in low-priced listings under $8,000, the typical student budget range.

How to Use a VIN Report When Evaluating a Car

Every potential car purchase should include reviewing a comprehensive vehicle history report. These reports reveal accident history, flood damage, previous owners, and service records. Smart students use this information to negotiate better prices. When buying from private sellers, insist on seeing the VIN report before signing any agreement. Such a step protects you from expensive surprises later.

Should You Buy From a Private Seller or a Dealership?

There are both advantages and disadvantages of buying from private sellers and dealerships. Thinking about where to buy your first car? Private sellers often provide lower prices. However, they offer no warranties. Dealerships typically charge more down payments. Nonetheless, they ensure auto loan options, warranties, and legal protections. Be particularly cautious with private sellers to avoid title washing schemes. Your decision should depend on your financial opportunities and comfort level with car negotiations.

| Source | Advantages | Disadvantages | Best For |

| Private Seller | Lower prices, direct negotiation | No warranty, higher risk | Cash buyers, experienced buyers |

| Dealership | Auto loan options, warranties, and legal protection | Higher prices, sales pressure | First-time buyers, those needing loans |

| Online Platforms | Wide selection, price transparency | Shipping fees, limited inspection | Tech-savvy buyers, specific model searches |

Why Insurance Costs Should Affect Your Car Choice

Insurance represents one of the largest ongoing expenses for student car owners. It often requires $150-300 monthly payments. The car you choose dramatically impacts these rates. Sports cars and luxury models carry significantly higher premiums. Young people should get coverage quotes before finalizing any deal. Such an approach helps avoid budget-breaking surprises. Many insurers offer student discounts for good grades. Defensive driving courses or bundling with family policies are additional options. Consider these factors:

- Age and value: Newer cars require comprehensive coverage; older cars allow liability-only options.

- Safety ratings: Cars with high safety scores are suitable for discounts.

- Theft rates: Popular models with high theft rates carry higher premiums.

- Repair expenses: Luxury cars and imports typically charge more to insure due to expensive parts.

- Student discounts: Maintain good grades and consider defensive driving courses for lower rates.

According to EpicVIN’s research, students driving sedans pay an average of 25% less than those driving SUVs or sports cars.

Is It Better to Buy a Car with Cash or Finance It as a Student?

The decision depends on your available funds. Also, consider the credit situation and long-term financial goals. If you pay cash, monthly payments are lower. However, this approach depletes your emergency savings. Getting a student car loan helps build credit history and preserves cash flow. Nevertheless, this approach adds interest expenses. Many financial advisors recommend getting a car loan only if you can secure lower interest rates (under 6-8%). You should have a stable income to support payment obligations.

| Payment Method | Benefits | Drawbacks | Best When |

| Cash Purchase | No interest, full ownership, lower insurance options | Depletes savings, no credit building | You have adequate emergency funds remaining |

| Traditional Financing | Builds credit, preserves cash, and offers potential tax benefits | Interest expenses, monthly obligations | You qualify for reasonable rates |

| Family Loan | Low/no interest, flexible terms | Family complications, no credit building | The family can afford to lend |

| Lease | Lower monthly payments, warranty coverage | No ownership, mileage limits | Short-term need, low mileage |

How to Get a Car Loan While in College

Securing a car loan as a college student requires understanding lender requirements. Traditional lenders want steady income, challenging for young people with part-time jobs, especially those from low-income families. Credit unions offer flexible terms and lower interest rates. A co-signer's participation improves car loan approval chances.

Gather documentation - income proof, enrollment verification, and credit history. Shop around with multiple lenders. Apply to several institutions to find the best terms. Student car loans have flexible requirements. They may not need a co-signer if you prove repayment ability. Some lenders provide access to financing for those who might not qualify elsewhere. However, higher interest rates are offered. Taking on debt requires careful consideration of your ability to repay fixed monthly payments. Before putting your signature, ensure you can realistically manage the auto loan. Not all young people should take on car loan debt - only those with stable income and realistic plans.

Summary

Buying a car as a student requires balancing. Consider your transportation needs and financial reality. Focus on fuel-efficient models. Don't forger about expenses - insurance, maintenance, and parking fees. Ensure you can comfortably afford all associated expenses. Your first car doesn't need to be perfect. It just needs to be affordable for your current situation. The idea is to get safe transportation that serves your needs.

Frequently Asked Questions

The average American buys their first car at age 18-19. Nonetheless, this varies significantly by region and family income. College students often delay purchases until their sophomore or junior year. By this time, they can establish income and credit.

Finishing school doesn't automatically cancel your auto loan obligations. You must continue making payments. Otherwise, you risk damaging your credit. Consider contacting your lender immediately. Discuss such options as payment deferrals if you're unable to continue payments.

New Hampshire, Delaware, and Montana are the states with lower total expenses. There are no sales taxes here, which helps reduce expenses. However, consider insurance rates and emissions requirements. They may vary significantly by location.

In most states, a permanent address for registration is required. However, college students can often use their current address/family home. Check your state's specific rules and laws.

Manual transmissions typically cost less initially. They offer better fuel economy. Consider these factors:

- Lower price: Manual cars are cheaper than automatics ($800-1,200 less).

- Better fuel efficiency: Ability to save 5-15% on gas annually.

- Cheaper maintenance: Fewer complex components mean lower repair bills.

- Limited selection: Fewer manual options are available in the used car market.

- Resale challenges: Harder to sell when you're ready to upgrade.