Determining a car's salvage value highlights when your vehicle was damaged. No matter whether you're maintaining, selling, or parting out your car. Grasping how to determine salvage value prevents leaving money on the table. Negotiate with insurance companies more productively.

What Is a Salvage Car and How Does It Lose Its Value?

An example of a salvage vehicle is the one declared a total loss. An insurance company typically assigns this status to the car after an accident. Natural disaster or theft recovery are also common prerequisites. When an auto receives this title, its value drops by 60-75%. Compared to the car’s pre-damage market value, this indicator is critically low.

Repair costs, as well as safety and reliability issues, are the reasons for the lost resale value. Therefore, determining whether the car meets the corresponding criteria is an important task.

When Does a Vehicle Receive a Salvage Title?

A wrecked vehicle receives a salvage title under certain conditions. The most common prerequisite is when an insurance company determines maintenance costs exceed a certain sum of the car's actual cash value. This is typically 75-90%, but the sum may depend on state laws. The percentage of vehicle damage should be taken into account. E.g., the car's market value is $10,000; all planned repairs cost $8,500. Thus, it's likely a total loss.

The threshold varies by state rules. Insurance companies and dealers also consider salvage value when calculating property damage claims. If they can recover money by selling the damaged car to a salvage yard, they're more likely to total it rather than pay for extensive repairs.

Do All Salvage Cars Lose Value Equally?

How Is the Value of a Salvage Car Determined?

Insurance adjusters and dealers rely on specific formulas to identify the car's salvage value objectively. While exact methods vary between companies, most follow similar principles to calculate the post-accident value of a vehicle. Here's how the basic formula works for determining salvage:

| Formula Component | Description | Example Calculation |

| Pre-accident value | The vehicle's actual cash value before damage | $15,000 |

| Salvage percentage | The estimated percentage of remaining value (typically 20-40%) | 30% for moderate damage |

| Calculation | Pre-accident value × Salvage percentage | $15,000 × 0.30 = $4,500 salvage value |

How Insurance Companies Calculate Salvage Payouts

When processing property damage claims, insurance companies calculate the salvage value through a systematic approach that balances their financial interests with fair compensation. Their process typically follows these steps:

- Determine the vehicle's actual cash value using online resources, car guides, and similar car sales in your area.

- Calculate repair costs using estimates from authorized maintenance centers (often getting three estimates and comparing vehicles of the same make).

- Assess the vehicle's post-repair diminished value and potential safety concerns.

- Determine the salvage value from the pre-accident fair market value.

- Offer a settlement based on the difference, minus your deductible.

Does the Type of Damage Affect Salvage Value?

Cosmetic damage from hail maintains higher salvage values than severe weather events like floods, which cause hidden electrical problems. Fire and structural frame damage result in the lowest salvage values. Some salvage cars with low resale value may still contain valuable undamaged components for buyers looking to get a salvage car back on the road.

The Hidden Risks of Buying a Salvage Car

Even when a salvage title vehicle looks perfectly repaired, potential buyers should determine the significant risks involved before making a purchase decision. These cars come with several drawbacks that might not be immediately apparent in a vehicle accident history:

- Insurance challenges – Many companies refuse coverage or charge premium rates.

- Unpredictable reliability issues from hidden damage not addressed during maintenance.

- Difficulty selling later, with 40-50% less retail value than a clean-title equivalent.

- Financing obstacles, as many lenders avoid salvage title cars.

- Safety concerns, especially if maintenance wasn't properly performed to manufacturer specifications.

How to Spot a Poorly Rebuilt Salvage Car

Look for mismatched paint, uneven panel gaps, or inconsistent wear patterns. Always run a vehicle history report and use a VIN decoder to verify parts. Have a mechanic inspect before buying a car with structural damage.

Salvage Car Insurance: Can You Get Coverage?

Most insurers offer limited coverage for salvage vehicles. Specialized companies focusing on rebuilt salvage vehicles ensure better customer service. They usually offer free consultation but charge 20-30% higher premiums. This reflects the increased risk.

When Is It Better to Part Out a Salvage Car Instead of Repairing It?

Consider parting out if maintenance estimates exceed 100% of the car's pre-accident value. Popular models with high-demand components and older luxury vehicles often contain parts worth more than the car's total salvage value.

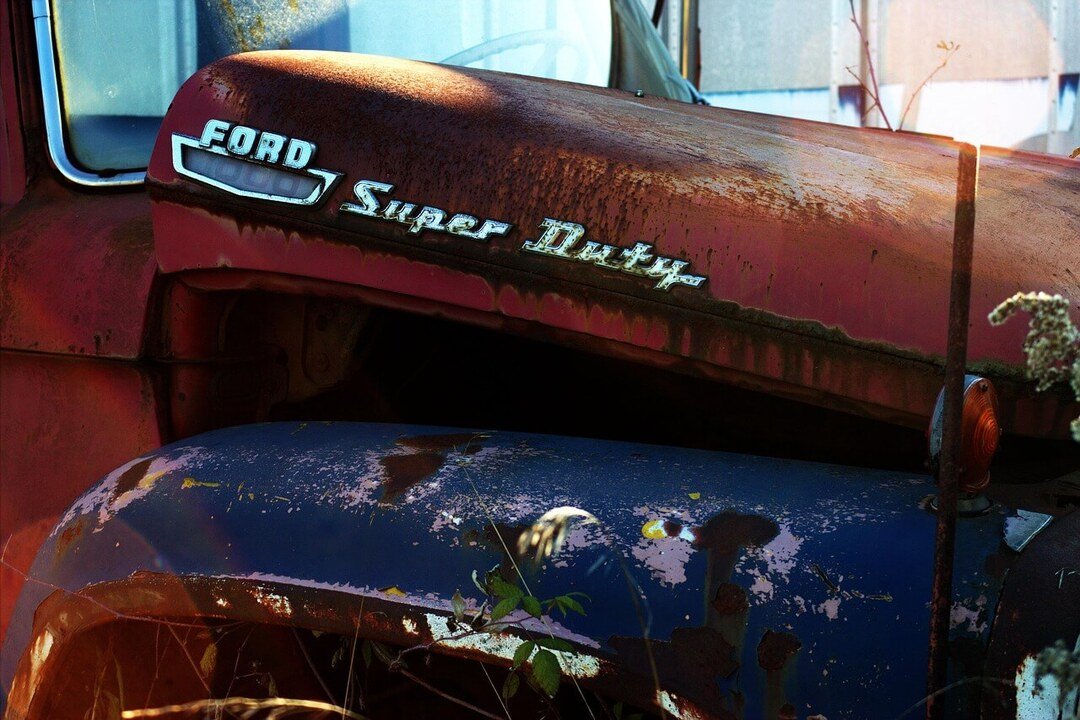

Cars That Retain the Most Value After a Salvage Title

Toyota, Honda, and Subaru typically retain 40-45% of pre-accident value compared to the average of 30%. Their abundant parts availability and reliability make getting this car back on the road more feasible. Trucks with superficial damage also hold value better.

Cars That Lose the Most Value After a Salvage Title

Luxury European vehicles retain only 20-25% of pre-accident value due to expensive parts and repair requirements. Sports cars and vehicles with complicated electrical systems suffer extreme devaluation. Cars with flood or fire damage lose substantial market value due to persistent electrical problems.

How to Sell a Salvage Car for the Best Price

Offering this vehicle to the market requires strategy and transparency to maximize your return. The key is finding the right buyer who understands the vehicle's condition and sees its potential wholesale value beyond its damaged status. Presenting complete documentation and being honest about the car's history builds trust and helps secure a fair offer with a good retail price:

- Get multiple offers from specialized buyers, not just your insurance company.

- Provide detailed maintenance documentation and inspection certificates if repairs were made.

- Consider online marketplaces that connect with rebuilders looking for specific models.

- Highlight valuable undamaged components when selling to parts specialists.

- Time your sale strategically—these vehicles often sell better in spring when repair shops are busiest.

- Consider selling to export markets where specific restrictions may differ.

Summary

Determining salvage value requires understanding both market factors and damage assessment. The formula balances the pre-accident value against damage severity, with most salvage vehicles retaining 20-40% of their original worth. Insurance companies and dealers calculate these values systematically. They consider repair costs, safety nuances, and parts value.

When thinking about whether to maintain, sell, or part out such a vehicle, consider all angles. Pay attention to repair costs versus potential resale value, insurance limitations, and the vehicle's specific condition. Remember that a vehicle history report provides essential context for any salvage car assessment. You can make informed decisions that maximize your financial outcome when dealing with such vehicles.

Frequently Asked Questions

No, residual value refers to a vehicle's estimated worth at the end of a lease term with normal use. Salvage value refers to a damaged vehicle's worth after being declared a total loss. This value is typically much lower. It depends on damage severity, maintenance costs, and the used car's pre-accident condition.

No matter whether repair costs exceed the actual cash value, you may still want to keep the car. Consider the following tips:

- Request a "retained salvage" settlement where you keep the car.

- Get independent appraisals if the insurance company offers seem low.

- Negotiate estimated costs with your preferred repair shop.

- Consider making some repairs yourself if you have mechanical skills.

Even severely damaged vehicles maintain some scrap value based on weight and materials. The negligent driver's insurance should still compensate you based on the vehicle's pre-accident actual market value. Minimal salvage prospects aren’t taken into account.

Seemingly perfect salvage autos often create confusion for potential buyers examining vehicle accident history. Here's why:

- Theft recovery vehicles may receive specific titles even with minimal damage.

- Repaired hail damage can restore appearance while maintaining salvage designation.

- Internal flood damage may not be visible externally.

- Damage to expensive components like hybrid batteries can total a car with an intact exterior.

Most states require a one-time inspection when converting from salvage to rebuilt title status. After this, most such cars follow standard inspection schedules, though state regulations vary. Determine and check specific state laws regarding salvage vehicle requirements.