A car is considered totaled when the cost to repair it exceeds its current value or meets your state’s total loss threshold. This typically happens after major accidents, floods, or fires. Recognizing early signs, like frame damage, airbag deployment, or very high repair estimates, can help you understand whether your vehicle is likely to be declared a total loss.

What Does “Totaled” Mean for Your Car?

This process protects both buyers and insurers by ensuring heavily damaged vehicles aren’t returned to the road without proper documentation. Understanding what happens after a total loss helps you plan whether to accept the payout or keep the car for potential salvage repair.

- Factors to consider include the vehicle history report, age, make, and any prior damage to your vehicle.

- The insurer also examines the vehicle's value against similar listings in your area.

About 18% of insured collisions result in a total loss. They happen mainly among older car models with significant structural damage.

How Do Insurance Companies Decide If a Car Is Totaled?

Some insurers adjust based on local demand. They also take into account the car’s age or trim. An insurance company may check how much the car’s value differs regionally. They can also verify whether parts are available for your make and model. To review data, you can check a VIN for accidents and compare similar listings.

| Method | Formula | Explanation | Example |

| TLF | Repair + Salvage ≥ ACV | If the sum equals ACV, the car is a total loss | $9,800 + $1,000 ≥ $10,000 |

| Threshold | Repairs ≥ % of ACV | Many states use 70–80 % as a limit | $9,000 ≥ 75 % of $12,000 |

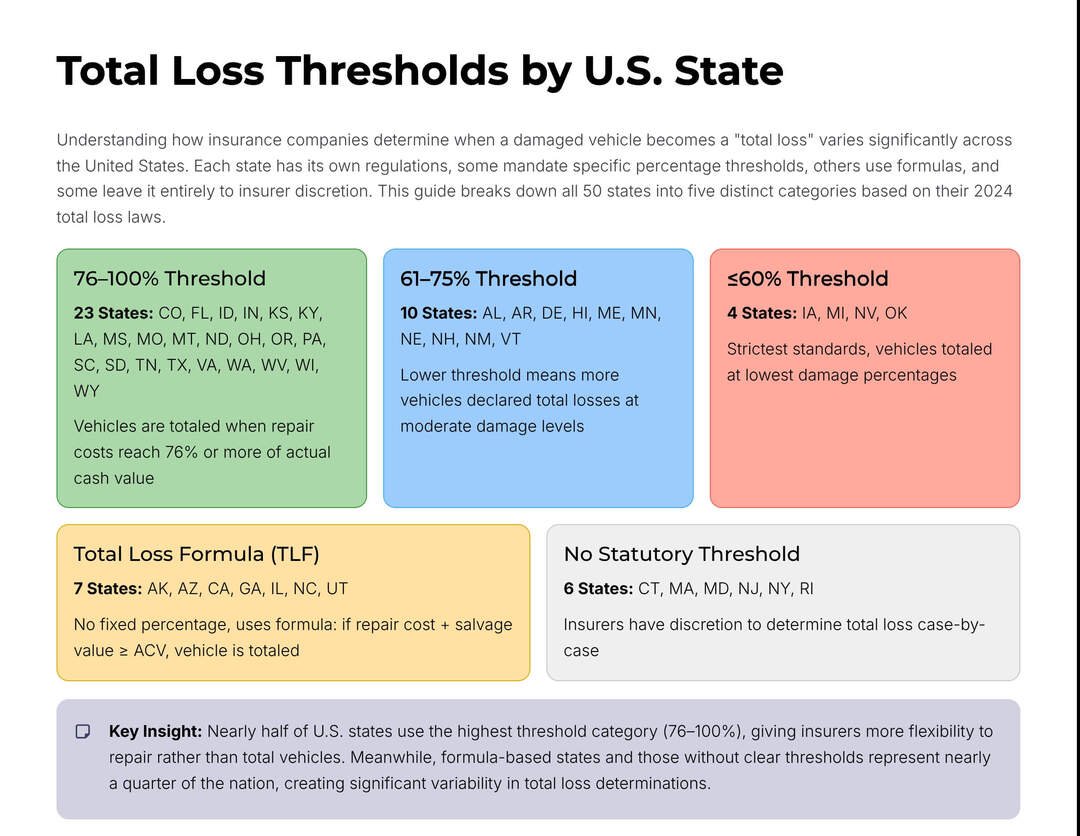

Most states set their total loss threshold at 70–80 %, depending on regulations and insurance coverage.

Example Total Loss Calculations

If your car’s actual cash value is $12,000, with repairs at $9,500 and salvage worth $1,000, the total is $10,500 - close to ACV. If additional damage is uncovered, like hidden frame issues, the cost could easily exceed the ACV, triggering a total loss designation. You’ll receive compensation based on the value of your totaled car before the crash.

Signs Your Car Might Be Totaled

Visible damage doesn’t tell the whole story. When frame rails are bent or the roof is crushed, costs rise fast. Modern systems like airbags and sensors add thousands of parts and calibration time. Severe flooding or fire also leads to total loss situations.

- Common signs your car is totaled include multiple deployed airbags, a warped frame, and damage affecting suspension or electronics.

- A car with an accident history or prior frame damage may become a car considered totaled after another crash.

- When structural integrity is compromised, the car isn’t safe even if it drives.

- If a technician says repairs exceed realistic value, it becomes the car a total loss under most state formulas.

Statistics show vehicles needing airbag replacements are 35 % more likely to be declared total losses.

How to Check If Your Car Is Totaled Yourself

Want to know if your car is a total loss before your insurer tells you? Use three numbers: your car’s current market value, the estimated repair cost, and its salvage value. If the cost to fix it (plus salvage) is close to or higher than what the car is worth, it’s likely totaled. This DIY method helps you avoid surprises, understand your payout potential, and push back if your insurer undervalues the damage.

Step 1: Find Your Vehicle’s ACV

Start by finding the market value of your car before the crash. Use listings of similar makes, mileage, and trim. The goal is to estimate the cash value of your car (the amount your insurer would pay if the vehicle is totaled). This represents the vehicle's value right before the accident and forms the basis for your payout.

Step 2: Get a Repair Estimate

Address a licensed body shop. Ask for a detailed quote covering parts, labor, and diagnostics. Ensure they offer calibration and frame-check costs. If the car is damaged underneath or has hidden issues, expenses rise. Submit this with your insurance claim under your car insurance or auto insurance coverage.

Step 3: Estimate Salvage Value

Owners of new cars hardly know what happens when an insurance company totals a car. Salvage value is what recyclers or auctions might pay for the wreck. Popular models fetch more; flooded or burned vehicles bring less. Confirm with your adjuster what they think the vehicle’s salvage value is. Repairs may be possible. However, car diminished value reduces its resale value.

- Review auction results for similar vehicles.

- Ask what parts are reusable.

- Check if modules, keys, and sensors are included.

- Note that insurers deduct salvage from your payout.

Step 4: Apply Your State’s Formula or Threshold

Add the repair estimate and salvage worth together. If the total meets or exceeds actual cash value, the vehicle is regarded as totaled. In threshold states, multiply ACV by the set limit. If the result meets that figure, the insurance company will typically pay you the value the car is worth, minus your deductible under your insurance policy.

Real examples:

- In Texas, a vehicle is only considered totaled if repair costs meet or exceed its actual cash value (ACV), offering insurers more flexibility in repair approvals. This is defined by the Texas Department of Insurance as part of their consumer auto claims guidelines.

- In Florida, the law mandates that if damage exceeds 80% of the vehicle’s ACV, it must be declared a total loss. This lower threshold is codified in Florida Statute § 319.30, leading to more vehicles being totaled after moderate damage.

What Happens After a Total Loss Declaration?

When a car is declared totaled by insurance, you’re paid its pre-accident value minus your deductible. The insurance company pays the lender first if there’s a car loan. Your settlement is reduced by its salvage deduction.

- Ask how the cash value of the vehicle was calculated.

- Provide records proving the value of your vehicle.

- Confirm if taxes and registration are included in the settlement.

- Keep receipts and correspondence.

Nearly 60 % of total-loss claims involve vehicles with outstanding loans. Insurers send payment directly to lienholders.

What Happens to the Title After a Total Loss?

After a vehicle is declared a total loss, the state issues a salvage or non-repairable title. The vehicle becomes rebuilt once inspected. What happens if your car is flood-damaged varies by state. However, most are automatically deemed totaled. Once a vehicle is totaled, the title permanently notes that status to protect future buyers.

Pros and Cons of Keeping a Totaled Car

Keeping a totaled car might make sense if the damage is mostly cosmetic. Nonetheless, a car with deployed airbags or hidden frame stress can be unsafe. Consider the car’s value after repairs versus the settlement offered. If repairs are manageable, you could restore it, but resale will always drop.

| Aspect | Pros | Cons |

| Cost | Can save money by repairing yourself | Payout reduced by salvage deduction |

| Safety | You know the car’s history | Hidden damage can remain |

| Value | Keep your car for daily use | Rebuilt branding lowers value |

| Ownership | Keep your car legal | Harder to insure again |

According to EpicVIN studies, owners typically retain their cars only if repair costs remain under 70 % of fair market value.

Can You Dispute an Insurance Total Loss Settlement?

Yes. If you disagree with the insurer’s valuation, gather documentation and submit evidence. Use a VIN decoder to confirm options that affect ACV. Provide comparable sales showing higher prices for the same trim. If the insurance company declares a lower payout, you can challenge it.

- Request the valuation sheet to see how the car is valued.

- Present receipts for new tires or equipment.

- If the amount seems unfair, ask for a review.

- If insurance pays below market value, escalate the claim or seek an independent appraiser.

Summary

To know if a car is a total loss, compare the cost of repairs and salvage with its actual cash value. When the total exceeds that value, your insurer settles instead of repairing. Grasping how insurance companies make these decisions ensures you get fair compensation if your car gets totaled after an accident. State laws and thresholds vary, so even similar damage may be treated differently across the U.S. Understanding your local rules empowers you to negotiate better and avoid surprises in the claims process.

Frequently Asked Questions

No. Each insurance claim is based on a single event when a car is getting into an accident. However, prior fixes increase the likelihood of how fast the car is regarded as a total loss, especially when damage accumulates over time.

Usually not. If repair costs stay below the total loss threshold, your car isn’t automatically totaled. Still, extensive aftermarket upgrades can raise expenses enough to total your vehicle.

Yes, especially if you totaled and you still owe on your loan.

- The lender remains on the title until the balance clears.

- GAP or loan coverage may help.

- The insurance company will typically list both parties on the check.

- Ask your insurer what happens if your car balance exceeds the payout.

Not always, but corrosion and wiring failure often justify total loss. When the car’s systems fail, most insurance companies prefer to total a car rather than risk unsafe repairs.

A car is considered a total loss when the insurance company declares it uneconomical to repair, that happens when the cost of repairs exceeds its value. Once a vehicle is considered totaled, the title is branded salvage. After repairs and inspection, it can be re-registered as a new vehicle, though resale and insurability remain limited.